I hate coins. Every time I'm handed change from a transaction, I cringe knowing that those coins are bound to either end up in my couch, bouncing around my dryer or wedged into some obscure corner of my car. Although Acorns does not solve my dilemma when it comes to physical spare change, it provides an extremely valuable service that allows users to invest small amounts from each transaction made on linked credit or debit cards.

Acorns: In a Nutshell

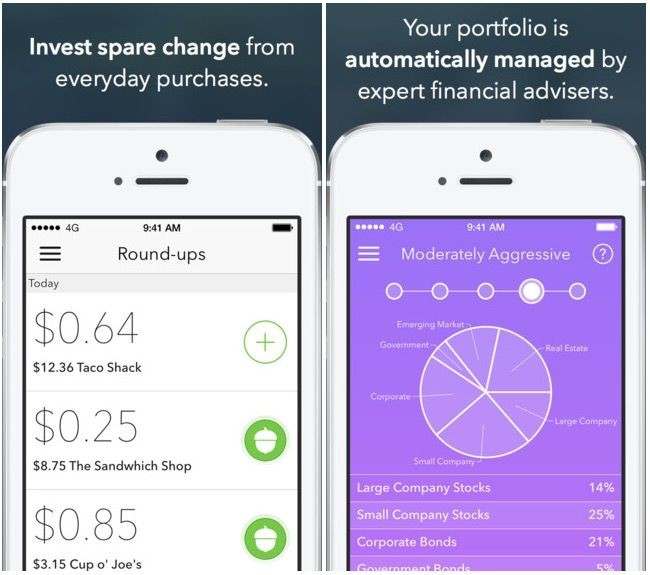

Acorns is considered a micro-investing app. The app links to a credit or debit card and rounds up each transaction you make to the nearest dollar. So, when I buy my latte at $4.65, Acorns rounds the transaction up to $5 and then invests the 35 cents. When you sign up for Acorns, the personal and financial information you enter in your profile prompts the app to automatically assign your micro-investments into one of five investment portfolios. Each portfolio carries a different level of risk and expected return. You have the option to change your investment portfolio at anytime. The Acorns portfolios are managed by a crack team of mathematicians, a Nobel Prize-winning economist and many engineers.

How Much Does it Cost?

How Much Does it Cost?

Acorns allows you to automatically or manually round-up your transactions. When your spare change reaches a sum of $5 or more, Acorns automatically deposits it into your portfolio. You can also link a checking account to the app and make deposits from it to your portfolio at any time. Acorns charges a $1 a month subscription service once you start investing, but there are no minimums, brokerage or commissions fees. You can withdraw from your portfolio anytime, in any amount, without facing any fees or penalties. Depending on your portfolio balance, Acorns charges an annual management fee ranging from 0.25 to 0.50 percent. On their website, Acorns states that "using Acorns for a year costs less than most traditional brokerages charge for 2 trades."

Security

With any app that requires so much financial and personal information as well as access to bank accounts, security is always a top concern. Every Acorns account is insured up to $500,000 for fraud and the app and website are secured with Symantec's 256-bit encryption. Acorns uses secure servers supported by McAfee and the app will alert you in the case of unusual account activity for your protection. To prevent from unwanted account access, Acorns uses multi-factor authentication, automatic logouts and ID verification.

Overview

Acorns is a great app that makes investing painless and easy. Instead of letting your change sit in a checking or savings account that earns negligible interest, use Acorn and watch your change grow into substantial dollars.